Mon-Fri 9am-5pm

(510) 285-9454

consult@mayenitalia.com

Blog

Home / BLOG

Achieving a Tax-Free Retirement: A Financial Dream Come True

As we navigate the intricate web of financial planning, retirement undoubtedly emerges as a significant milestone. It's a time to relax, pursue passions, and enjoy the fruits of our labor. However, ensuring a comfortable and financially stable retirement requires meticulous planning, and one aspect that deserves considerable attention is tax management.

In this blog post, we will delve into the concept of tax-free retirement and explore strategies that can help you maximize your savings and minimize your tax burden during your golden years.

Understanding Tax-Free Retirement Advantage:

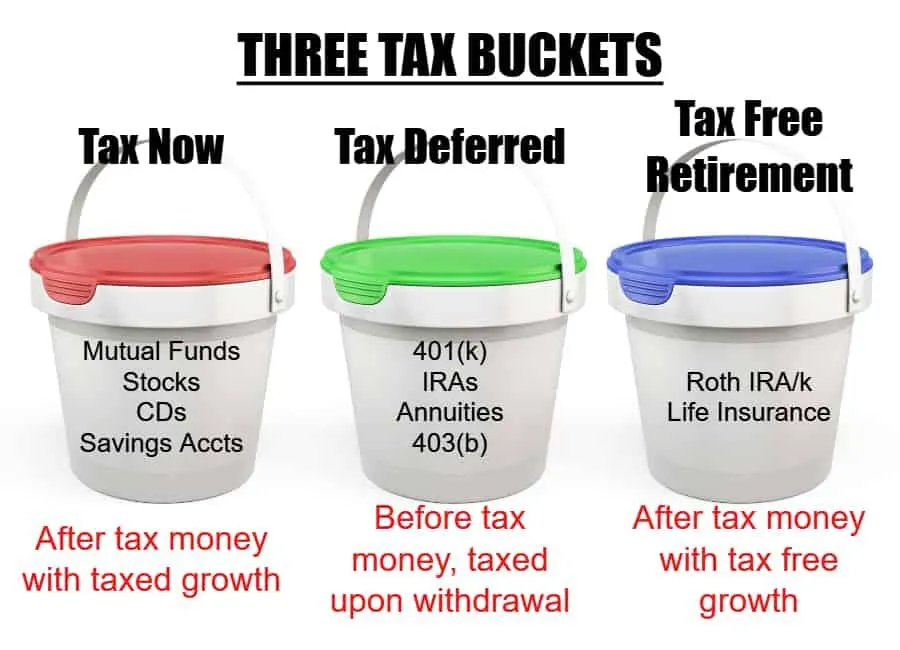

A tax-free retirement refers to a financial strategy that allows individuals to generate income during retirement while minimizing or completely eliminating taxes on those funds. This approach can substantially increase the amount of money available for retirement expenses and help preserve your hard-earned savings.

1. Roth IRA and Roth 401(k)

One of the most popular avenues for tax-free retirement savings is the Roth Individual Retirement Account (IRA) and Roth 401(k). Contributions to these accounts are made with after-tax dollars, which means you won't receive an immediate tax deduction. However, the earnings and withdrawals from these accounts are entirely tax-free, provided certain conditions are met. The advantage of these accounts lies in their potential for significant tax savings over time, especially if you expect your tax rate to be higher during retirement.

2. Health Savings Accounts (HSAs)

While primarily associated with medical expenses, HSAs can also serve as a powerful tool for tax-free retirement planning. HSAs offer a triple tax advantage: contributions are tax-deductible, growth is tax-free, and qualified withdrawals for medical expenses are also tax-free. However, once you reach age 65, you can withdraw funds from an HSA for non-medical expenses without incurring a penalty (though it will be subject to income tax).

3. Municipal Bonds

Investing in municipal bonds can be another tax-efficient strategy for retirement savings. Municipal bond interest is often exempt from federal income tax and, in some cases, from state and local taxes as well. By carefully selecting high-quality municipal bonds, you can generate tax-free income, enhancing your retirement cash flow.

4. Life Insurance Policies

Certain life insurance policies, such as cash value life insurance or indexed universal life insurance, can be structured to provide a tax-free income stream during retirement. These policies allow you to accumulate cash value on a tax-deferred basis, and withdrawals can be made tax-free, provided you follow specific guidelines.

5. Proper Asset Location and Diversification

Another critical aspect of tax-free retirement planning is optimizing the location of your investments. By strategically placing taxable and tax-advantaged investments in the right accounts, you can minimize the overall tax impact. Additionally, diversifying your investments across various asset classes can help balance risk and tax consequences, ensuring a more resilient retirement portfolio.

Conclusion:

A tax-free retirement is an achievable goal with careful financial planning and strategic decision-making. By leveraging the power of tax-advantaged accounts like Roth IRAs and HSAs, exploring municipal bonds, utilizing certain life insurance policies, and optimizing asset location, you can significantly reduce your tax burden during retirement. Consult with a qualified financial advisor to develop a personalized tax-free retirement strategy that aligns with your specific goals, risk tolerance, and financial circumstances. With the right approach, you can enjoy your retirement years with peace of mind, knowing that your hard-earned savings are working for you in a tax-efficient manner.

Discover How To Create The Foundation For A Tax-Free Retirement Without Any Additional Financial Outlay...

Whether you're just starting your retirement journey or looking to optimize your existing retirement savings, this training will equip you with the knowledge and tools you need to make informed decisions. Imagine retiring with peace of mind, knowing that you've taken advantage of tax-saving opportunities and maximized your nest egg.

Contact Us

Mon-Fri 9am-5pm

(510) 285-9454

consult@mayenitalia.com

© Copyright 2023. All rights reserved.